What is the Consumer Duty of Care?

The Consumer Duty of Care or Consumer Duty was brought in by the Financial Conduct Authority (FCA) to set out higher and clearer standards of protection for consumers in financial services. In short, firms should be putting consumers’ needs first and, if they do not, Senior Managers could find themselves accountable. So, what is the meaning of the Consumer Duty of Care?

What is the Consumer Duty of Care?

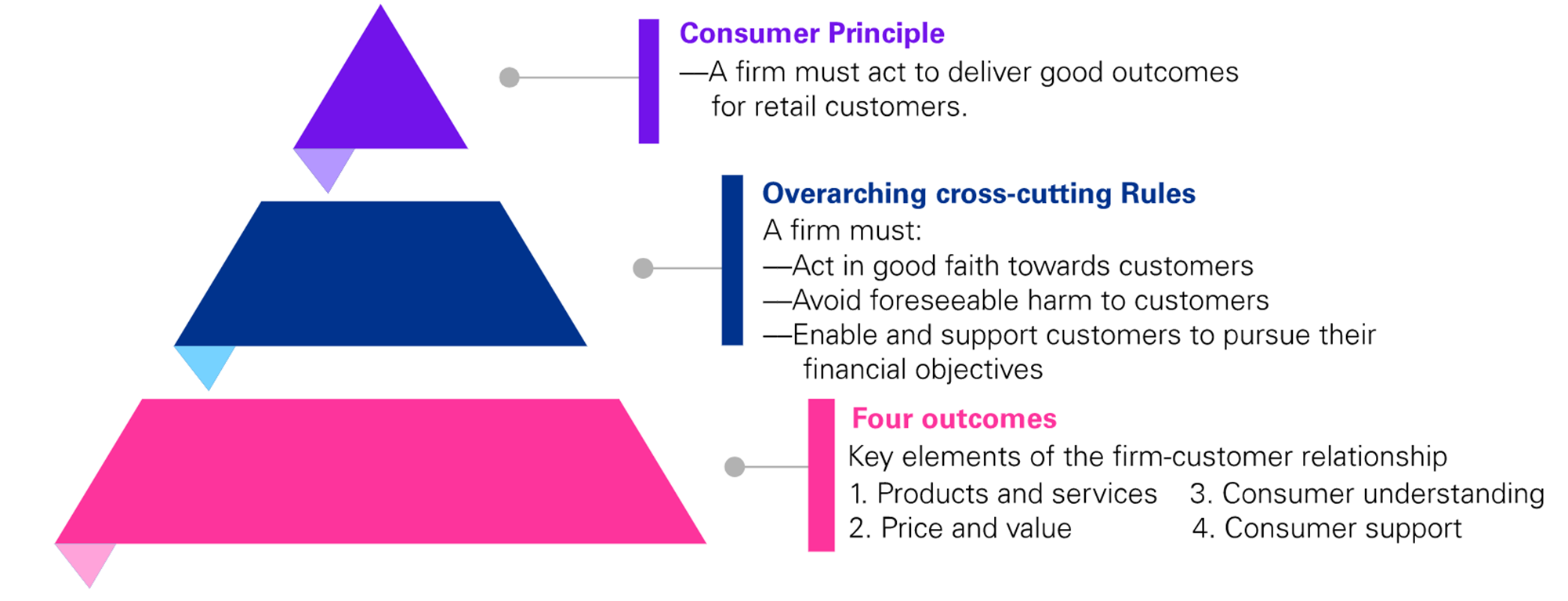

The Consumer Duty of Care is a new regulation from the FCA that sets out a requirement for firms to deliver good outcomes for customers. Whilst the expectation for good outcomes has always been there, Consumer Duty clearly sets out a higher standard to ensure firms understand what is expected of them and allows for more monitoring and intervention to assess compliance against 4 outcomes:

- Products and Services

- Price and Value

- Consumer understanding

- Consumer Support

This new regulation is drawing plenty of attention as it will impact all financial services firms, big and small. They will be expected to look at the outcomes to ensure that their customers’ interests are prioritised and that those outcomes are good, especially for their most vulnerable consumers. For example, the FCA have recently asked 9 banks to justify their interest rates on savings accounts under the price and value outcome.

What does the Consumer Duty of Care include?

The Consumer Duty of Care means that firms are required to deliver good outcomes for customers. It sets out higher standards clearly and the expectations of the FCA for firms to:

- Act in good faith

- Avoid causing foreseeable harm

- Enable and support retail customers to pursue their financial objectives

At its core, this regulation is to protect firms’ most vulnerable customers. In our latest SMCR Now! vodcast episode we spoke to Jon Ellis, Business Consultant and Consumer Duty of Care Expert, who explains “The Consumer Duty is about ensuring good outcomes for all customers. However, the focus can be somewhat weakened because of the very broad nature of the push against all customers. The complexity of financial services means that many individuals can easily be left behind or not adequately served. This regulation seeks to address that gap, ensuring that everyone, especially the most vulnerable, is catered for.”

What does the Consumer Duty of Care mean for firms?

The Consumer Duty of Care has already come into force but the first step for firms is to assess and understand the current outcomes for customers. These should be tested and evidenced against the new requirements to see where they are already achieving compliance and where there is work needed to improve. If they haven’t already, they will need to implement a strategy that harnesses the relevant data and technology to garner intelligence that will identify potential risks to good outcomes. The right strategy will likely vary depending on the size of the firms and the needs of their client base. The FCA recognise that the process of reviewing and understanding these outcomes may take time, but firms won’t be able to shy away from this responsibility. Firms will need to be open to the changes required to ensure these good outcomes for consumers.

For some firms, this could mean a real cultural change. So, it’s important that organisations realise that this isn’t a regulation solely for their compliance teams to be concerned with. “Firms should now take a very pragmatic approach to this” advises Jon Ellis, “By focusing very clearly on Consumer outcomes and understanding the measures applied against those, they can identify gaps and understand what they might need to do to be fully compliant. The risk is that Consumer Duty could become a compliance department-only exercise. Compliance is front and centre of this, but if you don’t have leadership from the top, then you won’t achieve the change that’s really meant by the FCA.”

Where does the Consumer Duty of Care fit alongside SMCR?

The Consumer Duty of Care is an all-encompassing regulation that will require firms to evidence good outcomes for their customers. All firms will be accountable for this, and responsibilities will need to be set out within the organisation. This naturally leads on from the Senior Managers and Certification Regime (SMCR) which aims to reduce harm to consumers and strengthen market integrity. Firms will be obligated to have a Consumer Duty Champion, usually a Non-Executive Director, and would be expected to assign one Senior Management Function (SMF) to be primarily responsible for Consumer Duty oversight. Their Statement of Responsibility would need to reflect this.

Responsible Senior Managers and/or Certified Persons will need to ensure the consistent interpretation and implementation of Consumer Duty policy and processes across the various business areas. For senior managers this will also need to be included in their Statement of Responsibility.

In terms of SMCR, a new feature is the 6th Conduct Rule relating to ensuring that Consumer Duty responsibilities are carried out. More about this in an upcoming blog.

Whether your firm is looking at SMCR or Consumer Duty, the road to compliance can often look daunting. We have the tools, training, and support to guide you towards compliance. You can find more information on the Consumer Duty of Care via the FCA Website or get in touch now to find out how we can help.